Making sure that you have healthcare coverage in the United States is extremely important. There is a lot of information out there about the different types of health insurance plans available, one of which is Medicare. For people who are 65 years of age and older, as well as people who are under the age of 65 and have certain disabilities, in addition to people of any age that have end-stage renal disease, Medicare is available. A program that is partly funded by payroll taxes from employers, employees, and people who work to self-employment, Medicare offers basic medical coverage to help people pay for things like hospital stays, surgeries, doctor’s visits, prescription medication, and more.

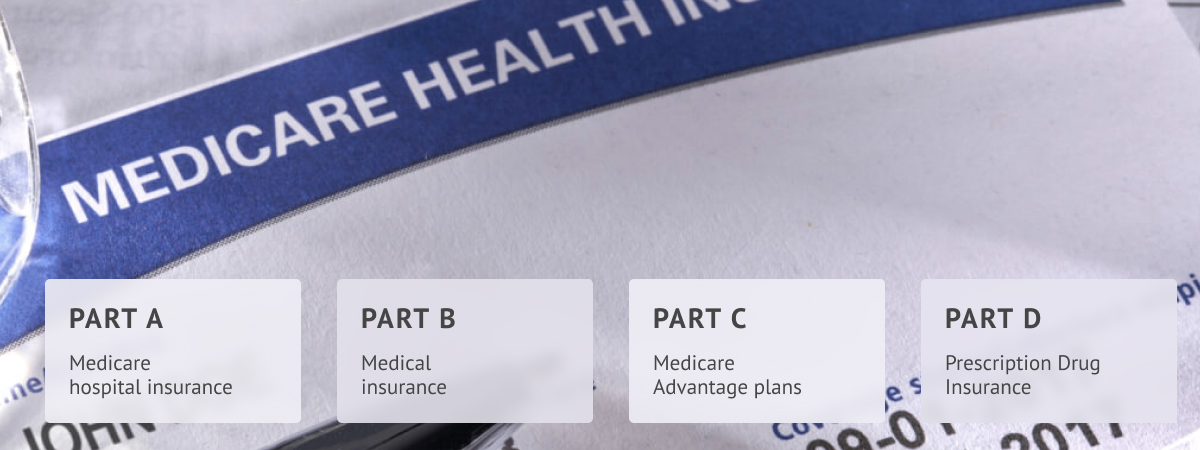

In order to simplify the process, while still giving people things to choose from, the Medicare program is divided up into multiple parts. People do not need to have any specific combination of plans, though some plans are required in order to get other plans. For people who do not get a Medicare plan during the timeframe allotted to purchase it, called the Initial Enrollment Period, penalties can be incurred. To learn more about the most prominent plans, Medicare Part A, Medicare Part B, Medicare Part C, and Medicare Part D, read on.

Medicare Part A and Part B are part of what is called Original Medicare. This coverage provides the most basic segment of healthcare through Medicare. Medicare Part C is available through private health insurance companies and is a way to increase the amount of coverage that you have. Part D is also a way to enhance your health insurance coverage and fulfill needs. Knowing what each of these types of Medicare are is an important step in selecting a policy for you.

What Is Medicare Part A?

Medicare Part A, which is also known as hospital insurance, is a base insurance plan that helps pay for medical services related to inpatient hospitalization. It also helps cover the costs of skilled nursing care. Offered to Americans who are 65 years of age, as well as people meet other specifications, Medicare Part A is offered to people who qualify at little to no cost.

Medicare Part A provides coverage for inpatient care in a hospital. It also covers skilled nursing facility care, inpatient care in a skilled nursing facility, hospice care, and home healthcare. For people who have worked at least 40 calendar quarters in a position where they paid Social Security taxes, there is no premium for Part A health insurance through Medicare. There is, however, a deductible for this type of insurance plan.

Enrollment for Medicare Part A must happen during your Initial Enrollment Period in order to avoid penalties. People who do not enroll at this point in time will have to enroll during general enrollment. There may be a penalty to pay for people who do not enroll during the initial enrollment period.

What iIs Medicare Part B?

Medicare Part B, which is also known as medical insurance, is a health insurance plan designed to provide coverage for medical services that are related to outpatient care, as well as doctor care. This health insurance program helps pay for the costs of necessary medical care and treatment. This can include necessary medical services or supplies, preventative care, clinical research, ambulance service, durable medical equipment, mental health services, and more. There is a premium that gets paid for people who choose to get Medicare Part B.

A person’s Initial Enrollment Period is the same for part B as it is for Part A. Enrollment in Part B is automatic if you are receiving Social Security benefits or Railroad Retirement Board benefits. It is possible to not pay the penalty for late enrollment for Medicare Part B if you have met all the requirements. Some people choose to stay on their employer's medical plan and join up with Medicare Part B at a later point in time. In many cases, there is no penalty applied if this situation occurs.

What Is Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, provides the same coverage as Medicare Part A and B, with a few additions as well. A Medicare Part C plan can provide coverage for hospital insurance, medical insurance, prescription drugs, and programs can have other benefits as well. The other benefits can include vision insurance coverage, hearing insurance coverage, dental insurance coverage, and other health and wellness programs.

What Is Medicare Part D?

Medicare Part D is also available. This insurance coverage is also called Prescription Insurance and offers coverage for prescription drugs. There are different plans available from different companies for Medicare Part D. The specific prescriptions that are covered in each plan are dependent on which program you select. Make sure to look at your plans drug formulary to confirm coverage for the prescription drugs that you need. The estimated average premium for Medicare Part D is $44 per month. Some of these plans have a deductible, while others do not.

Which Part Is Right For Me: Medicare Part A, B, C, Or D?

Deciding which Medicare plan is best for you can take a little bit of time. Factors that affect which plans you select include whether or not you have employer-provided health insurance or retirement provided health insurance. Other considerations include being aware of the penalties you may have to pay if you delay coverage and sign up at a later point. An excellent way to help determine which type of Medicare is best for you is to make a list of all of the things you currently need to have in your health insurance plan. This includes prescriptions, anticipated doctor’s visits, whether or not dental, vision, or hearing coverage is needed, and more.

Compare the available policies, including the estimated premiums you are given and make a choice that fits your unique situation. The tools on this site can help you decide and direct you to the best places to get your coverage.